Sponsored:

Video games have long evolved beyond simple entertainment — they’ve become laboratories for modern economics. In virtual worlds like World of Warcraft, CS2, or Valorant, the same laws operate as on global financial markets: supply and demand, inflation, speculation, scarcity, and even crises. Game economics isn’t just about the price of skins or in-game currency — it’s about how millions of players around the world recreate the behavior of traders, investors, and bankers without ever leaving their homes.

World Behind the Screen: Why Game Economics Matter for Understanding Finance

Video games stopped being “just entertainment” a long time ago.

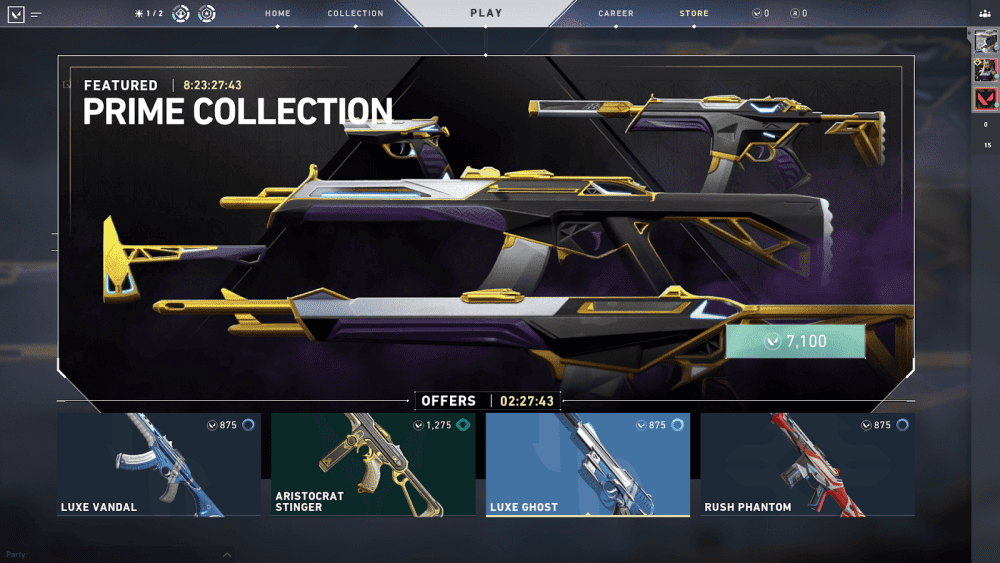

Modern massively multiplayer online games (MMOs) and even competitive shooters like Valorant create complex, dynamic economic systems that serve as perfect test grounds for observing real-world financial principles. While a viewer may follow a Valorant live score during an esports tournament, players themselves are often more concerned with in-game mechanics — the cost of skins, weapon prices per round, or the rarity of cosmetic items.

These virtual transactions, items, and markets are a direct, albeit simplified, reflection of global financial systems.

Game economics — or “gameonomics” — operates under the same core laws as real-world economies: supply and demand, inflation, speculation, and monetary policy. If a developer suddenly doubles the in-game currency supply, inflation follows, and the prices of rare items (like collectible skins) rise — exactly as they do when a central bank prints more money. Moreover, these virtual assets often gain real-world value through real-money trading (RMT), effectively transforming game items into financial assets.

Studying these virtual worlds offers a unique advantage: we can observe how millions of people influence prices and market stability — without risking billions in real losses. Game economics, aka gameonomics provides a powerful lens to understand how human psychology, resource scarcity, and regulatory efficiency (game rules) shape both virtual and real economic landscapes.

Currency, Scarcity, and Demand: Economic Laws in the Digital Realm

Every successful virtual economy rests on three pillars also central to real finance: currency, scarcity, and demand. Game developers, in essence, play the roles of central banks and regulatory authorities, determining how these elements interact.

Currency and Monetary Supply

Most games feature an internal currency (gold, credits, gil, etc.) that acts as a medium of exchange, a unit of account, and a store of value. Developers constantly balance between creation (“faucets”) and destruction (“sinks”) of this currency.

If faucets operate too freely (e.g., easy quests give too much gold) and sinks are insufficient (few taxes or costly items), inflation sets in. This devalues the in-game currency, making gameplay meaningless — just as uncontrolled money printing collapses real economies.

Scarcity as the Engine of Value

Scarcity is the key factor that gives digital objects their worth. In a world where everything can be duplicated, scarcity is artificial — enforced by game rules. There are two main types:

- Time Scarcity: Items available only during limited-time events (seasonal skins, raid rewards).

- Effort Scarcity: Items requiring rare materials, high skill, or long grinding to obtain.

The harder something is to acquire, the higher its value becomes on the in-game market. This is imoportant in game economics.

Demand and Economic Psychology

Demand in virtual economies is driven not only by functionality (e.g., stronger weapons) but also by social prestige. Cosmetic items that provide no gameplay advantage (skins, emotes, mounts) often command the highest prices. This mirrors real-world consumer psychology, where brand and exclusivity outweigh utility.

Thus, digital environments demonstrate how fundamental game economics laws naturally emerge when a system is properly balanced — offering a controlled “laboratory” for studying how value fluctuates as regulators (developers) adjust money supply or scarcity levels.

Trade and Speculation: Players as Financial Agents

If developers are the central banks, players are the market participants — traders and speculators who drive the economy through transactions and arbitrage. In-game marketplaces, whether auction houses or peer-to-peer (P2P) trades, function almost identically to real-world commodity or stock exchanges, exposing the same crowd psychology, risk-taking, and profit motives.

The Role of Marketplaces

Game auctions embody classical market laws:

- Arbitrage: Skilled players buy goods cheaply (e.g., from new players) and sell them where demand is higher (central hubs), profiting from price discrepancies.

- Price Monitoring: “Flippers” track price trends for specific resources to identify optimal buying or selling times.

This mirrors stock traders exploiting inefficiencies between markets or exchanges.

Speculative Booms and Crashes

Perhaps the most striking parallel is speculation. Players often hoard specific resources when they anticipate upcoming patches that will increase their demand (e.g., new crafting materials). This creates bubbles in game economics:

- Accumulation: A player buys out all available resource “Y,” creating artificial scarcity.

- Price Surge: With no supply left, prices skyrocket.

- Crash: If the expected patch is delayed or developers add new supply sources, the bubble bursts, causing panic and sell-offs.

These dynamics demonstrate that emotion and expectation — fear and greed — often drive prices more powerfully than rational analysis, both in crypto markets and virtual economies.

Successful in-game traders effectively practice portfolio management, risk assessment, and market forecasting — valuable skills in real-world finance.

Fraud and Imbalance: Risk Management Lessons for the Real World

No economy is perfect. Game markets face the same challenges as global finance — fraud and systemic imbalance. How developers handle these threats offers real insights into risk management and regulation.

Virtual Crimes and Unregulated Markets

Common forms of in-game fraud mirror real financial crimes:

- Bot Farming: Automated programs monopolize resource collection — akin to unfair competition or insider trading, distorting markets for honest players.

- RMT (Real Money Trading): Selling in-game items for real cash outside official platforms creates a black market — similar to unregulated OTC (over-the-counter) trades vulnerable to fraud and money laundering.

- Exploits: Using bugs to gain unfair advantages (e.g., infinite currency) resembles system hacking or exploiting legal loopholes in finance.

Regulatory Response: Audits and Sanctions

Developer countermeasures closely parallel financial regulation:

- Monitoring and Audits: Tracking abnormal currency flows to detect bots or RMT — a virtual version of financial auditing and anti-money-laundering systems.

- Sanctions: Account bans and asset confiscation are equivalent to fines or license revocations.

- “Deflation” and “Resets”: In extreme cases, developers may remove excess currency or reset servers entirely — mirroring central bank interventions to restore trust and prevent collapse.

Game economics proves that sustained oversight and strong anti-fraud measures are essential to maintaining fairness and stability in any economy.

From simple rules of supply, scarcity, and currency to complex dynamics of speculation and black markets, game economics serve as transparent reflections of real-world finance. Virtual worlds act as laboratories where we can safely study how human psychology, regulation, and fraud shape asset value. Gameonomics shows that fundamental economic principles are universal — whether dealing with MMO gold, rare skins, or global stocks.

Ultimately, mastering a virtual game economics requires the same insight and discipline needed to navigate the intricate landscape of modern finance.

–

Sponsorship & Legal Disclaimer:

This article may reference game economics, gaming platforms, digital marketplaces, or financial systems that operate within virtual environments. Mentions of brands, platforms, or companies are for informational and editorial purposes only and do not represent paid endorsements or formal partnerships unless explicitly stated. When Respect My Region (RMR) participates in a paid collaboration or sponsorship, it will always be clearly disclosed.

The ideas discussed here — including “gameonomics,” virtual economies, and digital trading — are intended solely for educational discussion. Nothing in this publication constitutes financial, investment, or trading advice. Readers should not interpret any information as encouragement to participate in real-money trading (RMT), speculative activity, or unregulated digital markets, which may violate local laws or game Terms of Service.

Respect My Region, its writers, and affiliates make no representations or warranties regarding accuracy, legality, or financial outcomes associated with the topics discussed. All examples are hypothetical or based on public information within the gaming industry.

By reading this article, you acknowledge that Respect My Region is not liable for financial loss, digital asset issues, or legal consequences resulting from real-world application of the concepts described. Always do your own research and consult a qualified professional before making financial or investment-related decisions — whether in real life or in virtual economies.